The time it takes to update tax treaties? The case of the Netherlands

In our previous blog, we looked into how long OECD founding member countries take to update their (bilateral) tax treaty networks. In the present blog, we will look at the case of the Netherlands.

Read our previous blog about tax treaties.

The Netherlands is well known for its extensive tax treaty network consisting of (approximately) ninety tax treaties. Like the tax treaty networks of other states, it must be serviced and maintained to respond to tax issues that arise in connection with the evolution of the global economy. With respect to the average time it takes founding OECD member states to update their tax treaties, we previously concluded that it takes 18.58 years. But how does updating the Netherlands tax treaty network fare, specifically, with respect to tax treaties in force on 31 December 2019?

As regards the main question, i.e. how long does it take before a (bilateral) Dutch tax treaty is amended, the answer is: 16.54 years. With respect to this number, it is noted that it is based on a fictional cut-off – or amendment – date of 31 December 2019 for all Dutch tax treaties.

Looking in detail at the data concerning the Netherlands, the following can moreover be concluded:

- 58% of the tax treaties in force on 31 December 2019 have never been amended. With regard to these Dutch tax treaties that have not been updated, the average time that has expired since their conclusion is 25.6 years.

- 42% of the tax treaties in force on 31 December 2019 have been amended. The average time between the conclusion of the first tax treaty and their subsequent amendment(s) is 11.4 years.

- The average duration of a Dutch tax treaty, i.e. its ‘life-span’, is 25.32 years.

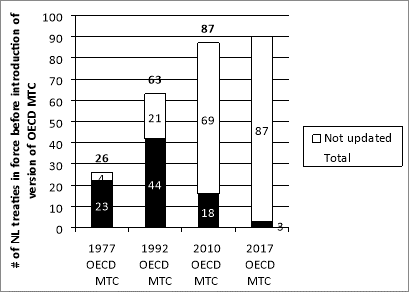

In addition to these general observations, it can also be assessed to what extent the Dutch tax treaty network is aligned with updates to the OECD Model Tax Convention. The OECD Model Tax Convention is regularly updated by the OECD to address challenges provided by the global economy, new business models, international tax policy, etc. With respect to such updates, the OECD recommends that its member states revise their bilateral tax treaties in accordance with the newest version of the Model. The figure below seeks to illustrate the amount of Dutch tax treaties updated after the introduction of the 1977, 1992, 2010 and 2017 OECD Model Tax Convention updates, respectively.

From this figure, which used ratification before or on 31 December 2019 as the cut-off date, the following conclusions can be drawn:

- There are only four tax treaties not aligned with the 1977 OECD Model Tax Convention update, i.e. the tax treaties with Ireland, Spain, Suriname and Thailand. As regards Ireland, it is noted that this tax treaty has been amended since 31 December 2019.

- The majority of the tax treaties concluded prior to 1992 have been updated since the 1992 update to the OECD Model Tax Convention and may, as such, be expected to be aligned with that update.

- The Dutch tax treaty network does not seem well-synchronised with the 2010 and 2017 updates to the OECD Model Tax Convention. As regards the 2017 update, it is noted, however, that some of its contents may be, or may already have been, implemented by means of the Multilateral Instrument used by the OECD to implement the outcomes of the Base Erosion and Profit Shifting Project.

In conclusion, the average time between updates to the Dutch tax treaty network is 16.54 years with 31 December 2019 as a fictional cut-off – or amendment – date.

Methodological note

It should be noted that the conclusions presented above are based on the database made for the purposes of our article “How Often Do OECD Member Countries Update Their Tax Treaties?”.

0 Comments

Add a comment